Following our article on the major banking apps, HSBC have today released their Fast Balance app for Android smartphones.

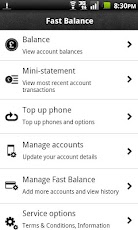

After a short registration process whereby you have to confirm your telephone number and personal details as well as entering your card numbers and setting up a security code, you are then connected to your accounts where you can view your balance, a mini statement detailing your last 6 transactions, top up a mobile phone andmanage your accounts contained within the app.

You can use Fast Balance with all HSBC Bank current accounts where HSBC have provided you with a debit card.

The HSBC Fastbalance App can be downloaded from here

Today’s smartphones are so powerful and diverse that they’ve replaced many of our traditional, everyday items such as the laptop, MP3 player, camera, and now, the wallet. With the rise of apps and new technology, mobile banking is becoming increasingly popular in the UK. Unfortunately, all the amazing data that your phone contains—including banking and payment info—makes it a very attractive target for the bad guys. According to the police, between 250,000 and 300,000 mobile phones are reported stolen each year in the UK.

The potential benefits of these technologies far outweigh the risks, so as long as you take precautions, you can reap the rewards. Lookout shares tips on how to stay safe while enjoying the convenience of mobile banking.

1. Set a passcode – That way, if your phone is lost or stolen, you can have peace of mind knowing your banking and personal data is safe. We also recommend that you and put an auto-lock on your device and set your screen to lock after five minutes.

2. Double-check web links, especially those that link to sites where you need to enter payment details. Sometimes people fall prey to “phishing” attacks by putting their details into fake apps or websites. In fact, Trusteer found that people are three times more likely to succumb to a phishing attack from their mobile device compared to their computer. Before you login, check to make sure you are on the right URL.

3. Set a strong password for your banking app. It should be a unique password that you don’t use anywhere else.

4. Make sure your banking apps are up-to-date. If there is bug or security flaw, the bank will generally release an update to fix it, so make sure you download all updates as soon as you are notified.

5. When you are downloading apps in general, make sure you are using trusted sources. This will minimise the risk of malware being downloaded onto your phone and accessing your information. As a guide, look at the number of downloads or rating the app has, or read reviews.

6. Download a mobile security app such as Lookout that will keep your phone free of bad apps that might contain malware and spyware, locate your device if it ever goes missing, and remotely wipe data if the phone is ever stolen.

With technology improving fast, what we thought as merely non-existent is now becoming a reality. So much like Mobile Banking, and anything else related to man’s journey towards technological innovation. Mobile Banking is definitely a significant contribution, and it is inevitable that it welcomes different types of prey who are closely eyeing on what they, too, can benefit from it. So just before they get their claws into your phone and pry the information out, it’s a smart idea to keep track of effective ways to protect it. Those tips surely help!

Its on iOS and Android. Any word on when a windows version of the app will be released… that’s if one is in development of course!